When Nonprofits Profit: The Problem of Charity Misspending

Americans often take pride in giving back to their communities by donating to charities and nonprofits. Despite this, many of these groups misallocate their funds, betraying the trust of the public, and oftentimes their own mission statements, in the process.

Nonprofit organizations are groups that have been granted tax-exempt status by the IRS due to the belief that they further social causes or provide public benefits. This status means that the groups do not have to pay taxes on their incomes and that donations to them are tax deductible. Charities, meanwhile, are nonprofit organizations which have been established to serve the public benefit, and are not supposed to turn a profit — meaning accumulate large amounts of assets — or benefit any individual owner.

Many charities do not follow these guidelines, however, and have been accused of misallocating funds, focusing on accumulating assets and overpaying their staffs.

This trend is exemplified by the practices of the Susan G. Komen Foundation, a charity that markets itself as raising funds for research on breast cancer, and has been protested by a group called “Cure Komen” for misallocated funds. The protests began in reaction to the Komen Foundation’s latest budget, in which only 16% of the group’s expenses went towards funding research, while 47% went to “education” — meaning efforts to raise public awareness about breast cancer — and 15% went to fundraising. Many other cancer research charities, for comparison, spend at least 90% of their expenses on research. While “Cure Komen” is an extreme example, it is emblematic of a larger problem among American charities.

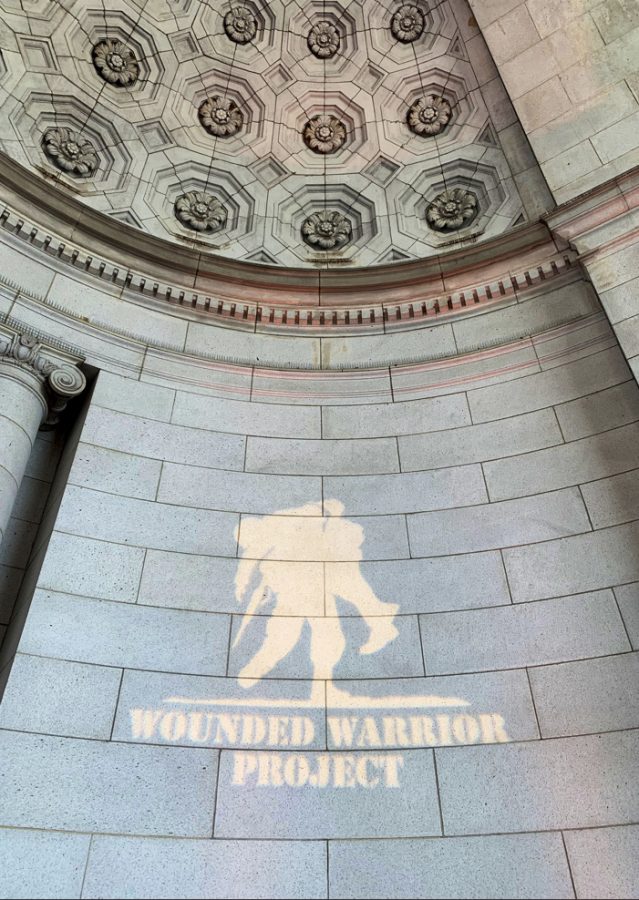

A more prominent scandal occurred in 2016, when a CBS investigation discovered chronic mismanagement within the Wounded Warriors Project, revealing that the group’s claim that 80% of its expenses go toward programs benefiting wounded veterans included costs for promotions, advertising and shipping, among other costs. The investigation eventually found that the group only spent 55–60% of its budget on programs directly benefiting veterans, while comparable groups, like the Fisher House Foundation, spend over 90%. Additionally, CBS discovered that the group had over $248 million in assets and was accumulating more.

These reports caused a massive backlash and forced the resignation of the CEO and CEO of the group, along with pledges of internal reform. While donations to the group were nearly halved over the following two years, the group began rebuilding itself in 2018, claiming that it had undergone extensive internal reforms. However, despite these pledges, Wounded Warriors Project increased spending on salaries from $48.5 million in 2017 to $63 million 2018, while its assets peaked at $317 million in 2017 before falling slightly to $305 million in 2018.

Ethical issues concerning the spending habits of charities also extend to the salaries of their leaders, which can exceed $1 million a year.

The highest-paid leader of a charity in the United States is Craig B. Thompson, the president/CEO of the Memorial Sloan Kettering Cancer Center, who was paid over $5 million in 2017. Scott A. Blackmun, the former CEO of the United States Olympic Committee, meanwhile, was paid nearly $3 million in 2018; while the American Cancer Society and American Heart Association both paid their highest-earners nearly $2 million in 2017 and 2018, respectively.

These groups have an obligation to be honest with the public about how they spend their money, and should remain true to their stated purpose of benefiting the public.

Despite this obligation, many have proven that they are incapable of internal reform. In light of this, Americans should research the spending habits of organizations before donating to them, and should understand that their money often does not benefit the cause they support.

Collin Bonnell, FCRH ’21, is a history and theology major from Hingham, Mass.

Pat Girondi • Nov 7, 2019 at 1:28 am

As Founder and Leader of Errant Gene Therapeutics, I lead by example, sacrificing and investing. The modern CEO (Crazed Egotistical Opportunist) mentality is killing our patients. Their out of line, ridiculous, unethical and damaging compensations weigh down companies, drive costs up and see less products getting to patients. Their pump and dump schemes, and Public Relation storms cost patient lives.

Pat Girondi • Nov 7, 2019 at 1:13 am

As the CEO of a Errant Gene Therapeutics, I appreciate the editorial. I don’t know how we have fallen into this abyss. As the founder, leader, I am the first to invest and sacrifice. My example is critical to keep things efficient. Today’s CEO (Crazed Egotistical Opportunists) are killing our nation, industry and patients with their out of line compensations and pump and dump mentality. Their behavior is literally hindering patient care which is what the industry should be focused on.