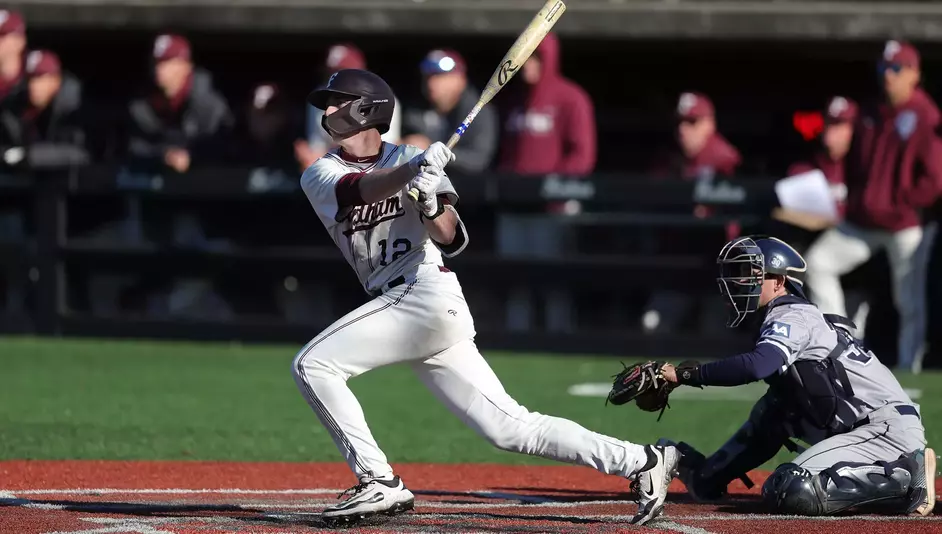

Fordham Students Try to Capitalize on GameStop Trading Frenzy

GameStop is not simply a relic from a time before video game enthusiasts could purchase and download the newest game from the comfort of their homes. For Phillip Wang, GSB ’21, the electronics retail company also presented an opportunity to participate in one of the biggest Wall Street trading frenzies of the past several years.

Wang has been an investor since his freshman year at Fordham. Initially, the stock market presented an opportunity for him to make long-term investments and take bigger risks with individual stocks that excited him, he explained. GameStop became one of those stocks.

The company garnered national attention after its stock value exploded in January, fueled by amateur traders, many of whom belong to an online community of investors on Reddit. The company’s stock price had been slowly creeping up through the latter half of 2020 but began climbing more rapidly in January of this year, according to data collected by Google Finance. On New Year’s Eve, GameStop stocks (abbreviated as GME on the New York Stock Exchange) were valued at $18.81. Three weeks later, on Jan. 22, the stock had jumped to $39.12. And just six days later, GME had climbed to a staggering $347.51 per share.

But why did GameStop experience such a sudden increase in value? For many Reddit users who frequented the subreddit “r/WallStreetBets,” it had not seemed sudden at all. The online community is a place for individual investors to post memes, learn from other investors and advocate for stocks they believe will increase in value. GameStop had been gaining traction as a good investment for several months in the community, particularly after an investment firm owned by Ryan Cohen, the founder of the online pet supplies retailer Chewy, bought a stake in Gamestop and joined its board last summer. Since then, Reddit users had been making the case for GameStop and encouraging other users to buy shares.

Griffin LaMarche, FCRH ’22, another student investor, said he first read about the buzz surrounding GameStop on the subreddit late last year.

“There’s always different little groups of people that pick a stock and say, ‘Oh, this is going to go up, or this is going to go down,’” said LaMarche.

Still, LaMarche was not entirely convinced that GameStop could bring in the kind of money some users were claiming it could, so he did not immediately invest.

Wang had also begun to frequent the subreddit in the early months of 2020. For him, the forum represented a good place to see where other small-time investors were putting their money. “It’s a good jumping-off point to do a lot of research on stocks,” said Wang. Wang said he has made money in the past after investing in stocks that were getting buzz in the “WallStreetBets” community, but he, like LaMarche, still did not take the prospect of winning big with GameStop too seriously when he first invested in the company. He bought shares in December at around $20 but sold them by early January at about $40. “I didn’t like that half of my portfolio was ‘meme stocks,’” he explained.

To Wang’s dismay, not long after he sold his GameStop shares, GME stock began to surge more and more rapidly. Eager to cash in on the rising tide, he repurchased shares at roughly $150 per share. “It’s definitely a really high-risk stock,” said Wang. “I’m definitely not putting in money I wouldn’t be comfortable losing completely.”

Why the sudden surge? Reddit users and small investors were not simply attracted to GameStop because of the company’s perceived virtues. Some investors had also noticed that several established Wall Street hedge funds, including Melvin Capital, had been shorting GameStop stock. This means that these larger investors essentially bet against the company, guessing its value would fall significantly.

In order to short a stock, these investors borrowed shares from another investor and sold them again immediately. If the stock fell, the investors who shorted the stock could buy back the shares at a lower price and return them to the original investors, keeping the difference and making a profit. But if an investor shorting a stock is wrong and its value goes up, they still have to buy back and return the shares, this time losing money.

This is exactly what happened to Melvin Capital and the other hedge funds that shorted GameStop. When small investors like Wang and LaMarche kept buying shares in GameStop, the company’s value went up and its shares became more expensive. When the panicked hedge funds had to buy back the shares of GameStop they borrowed, they also contributed to the stock’s rapid surge in value, creating what is known as a short squeeze.

In the end, hedge funds lost billions of dollars. For some small-time investors in GameStop, that had been part of the fun. As more people bought shares in GameStop, a populist attitude developed on social media demonstrating the power of individuals to make waves on Wall Street. When LaMarche purchased an option in GameStop in January, profit was his main motivation, he explained. Still, he said he was struck by the rallying cry of investors who wanted to fight back against established Wall Street firms. “While I don’t want to say you could make real change [by investing], people have more power than they think,” said LaMarche.

Though LaMarche ended up losing roughly $500 on GameStop, he’s still looking to invest in other companies in the future and never invests money in risky stocks that he cannot afford to lose. For now, Wang’s second investment in GameStop hasn’t led to any big returns either. He did not sell at the highest point of the stock’s rapid increase in value, and the stock has fallen significantly during the first weeks of February. As of this article’s publication, GME stock is valued at $59.10 per share, according to Google Finance. Wang said he hoped for another increase in value so he can sell again.

Andrey Ermolov, a financial economist and professor at the Gabelli School of Business, said he believed the GameStop debacle will teach both big Wall Street investors and individual investors a valuable lesson. “These types of episodes teach investors by experience,” Ermolov said. “A lot of professional investors were shorting GameStop. Now they lost a lot of money, so the next time they will … be more attentive to their decisions.”

Ermolov said new investors who had tried to cash in on GameStop and failed had also likely learned to be more careful as well. “If there is an episode like this in the future, it will be smaller because people betting on both sides will be more cautious,” he explained. “There is a reason that these kinds of episodes happen not every day but once every two or three years. People learn from their mistakes, and they change their behavior.”

Ermolov said that while it is perfectly acceptable to gamble on the stock market with stocks like GameStop, he recommended that students interested in investing for the first time should focus on building a well-diversified portfolio and suggested they find a brokerage firm with a good promotion for opening a new account. He personally advised investing in an exchange fund that gives an investor access to the entire S&P 500, the 500 largest publicly-traded companies in the United States.

Ermolov also emphasized that to make money as an investor, students should think long-term. He said research suggests that investors cannot really tell when it is the best time to buy or sell. “Just put money there and wait for ten to 20 years, and this almost guarantees you very strong returns,” he said.

Abbey Delk is a junior from Wheeling, West Virginia, double majoring in English and journalism and minoring in film & television. Her career at the...

MaryAnn Abraham • Feb 10, 2021 at 3:17 pm

Well done, Abbey. Paw-paw would have been very impressed and proud !