Americans Should Embrace Financial Literacy

No matter how you slice it, high school is an unforgettable experience to many in today’s society. More often than not, it plays a pivotal role in the trajectory of many young people looking to become financially well-established.

Many high schools today boast a myriad of extracurriculars, advanced placement courses and other resumé builders. However, one thing I have rarely heard mentioned in this conversation is the fundamental structure that forms the foundation of career and financial success: financial literacy.

Though financial planning is often thought of as exciting, it also plays a crucial role in supporting oneself.

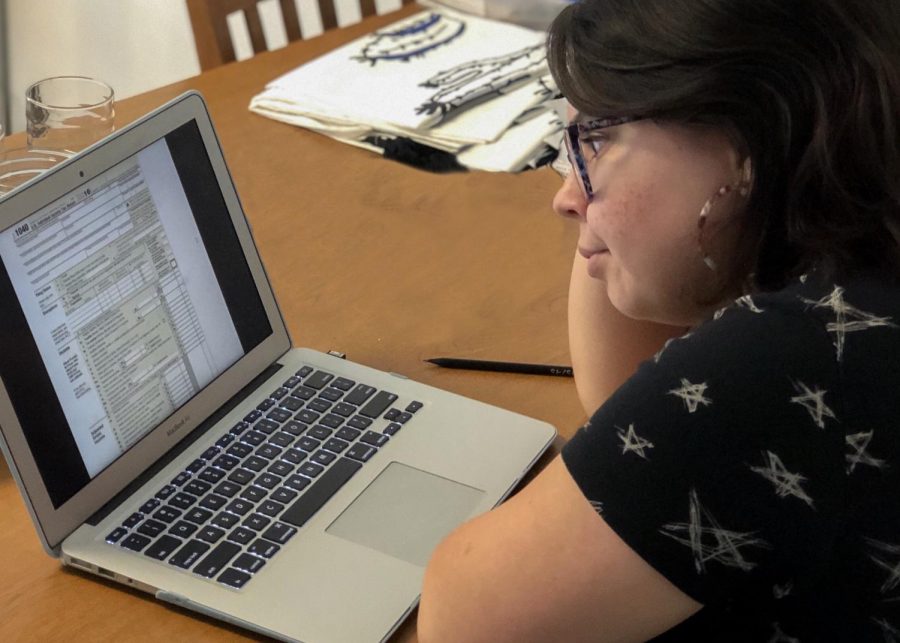

Financial literacy is the comprehensive understanding of money, including topics such as budgeting, investing, spending, paying off debt and more. Without a sense of financial literacy, there will forever be a stigma in the young adult mind that it is nothing more than an arbitrary, tedious affair shrouded in complex understandings of numbers, math, postulates and all of the other things we have come to dread as a society.

However, financial literacy is more complex than it appears.

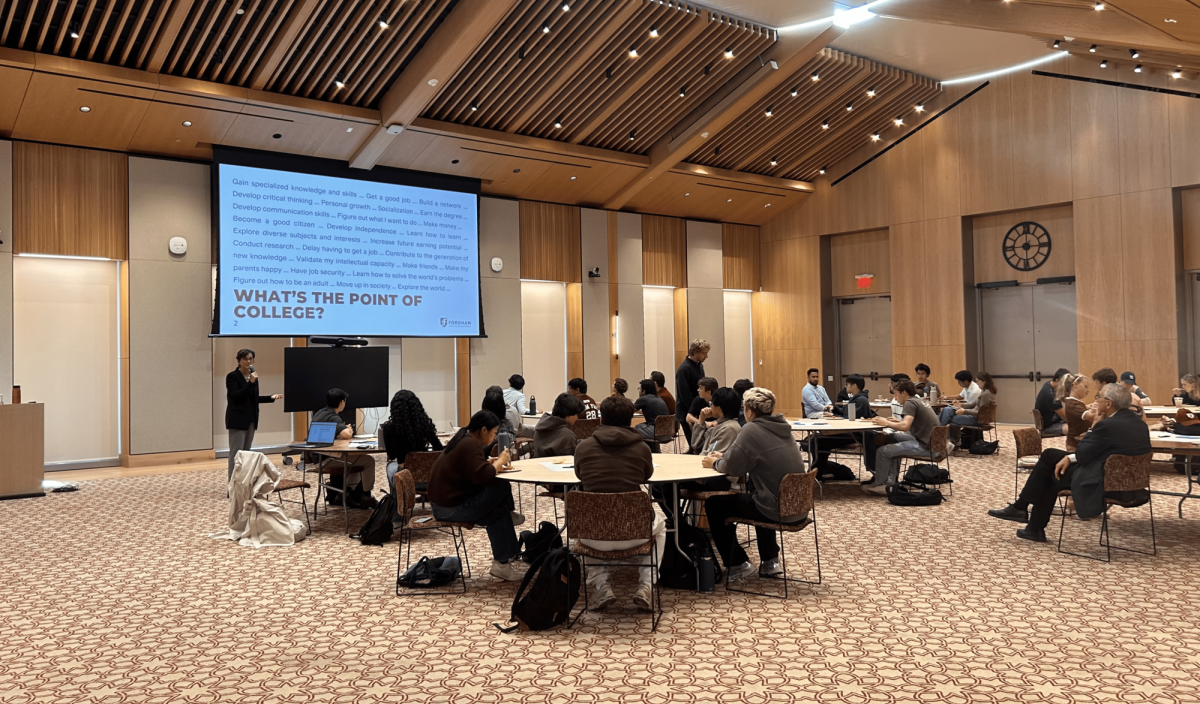

One way to introduce more people to the world of financial planning would be to introduce it to American schools. If the American education system were to encourage the teaching of financial literacy, more Americans would not only know how to survive in a constantly fluctuating economy but thrive in it.

According to the Federal Deposit Insurance Corporation, approximately 6.5% of Americans were unbanked as of 2017, which is praised as a record-low from the prior 8.2% in 2011. While these numbers could be due in part to barriers like poverty and lack of access, a lack of financial literacy among the American public is likely another contributor. This is why I believe that financial literacy courses should not be a choice, but an obligation.

Many Americans fail to recognize that it is imperative to have an understanding of money, how it works, how one can use it with a sense of shrewd decision-making and how to acclimate to an ever-changing economy.

According to a quiz study that was conducted by CNBC, approximately 94% of Americans were below competency in fundamental concepts dealing with financial literacy.

These numbers are rather troubling. Without at least some level of financial literacy, college students can and will find themselves inundated in seemingly-insurmountable piles of debt.

But it does not have to be this way. The American education system could undergo an overhaul in which it opts to introduce a course that will forever shape the way we choose to live our lives.

Instead of superfluous extracurriculars, our government should allocate more funds to the establishment of financial literacy courses. As a result, we may see less debt in our country, efficient spending and shrewd business decisions going forward.

Emphasis on the terms “going forward,” as a study done on behalf of Business Insider reports that approximately 61% of adults in the United States don’t keep track of their money, how it’s budgeted and how it’s spent.

You must be cognizant of the fact that by choosing to invest more in financial literacy courses, no one loses.

Either way, there is something to be gained from the knowledge offered by a financial literacy course.

An investment in financial literacy would be the best investment for our generation and those to come if financial literacy classes became a new investment.

And that is something I would not mind betting my last dollar on.

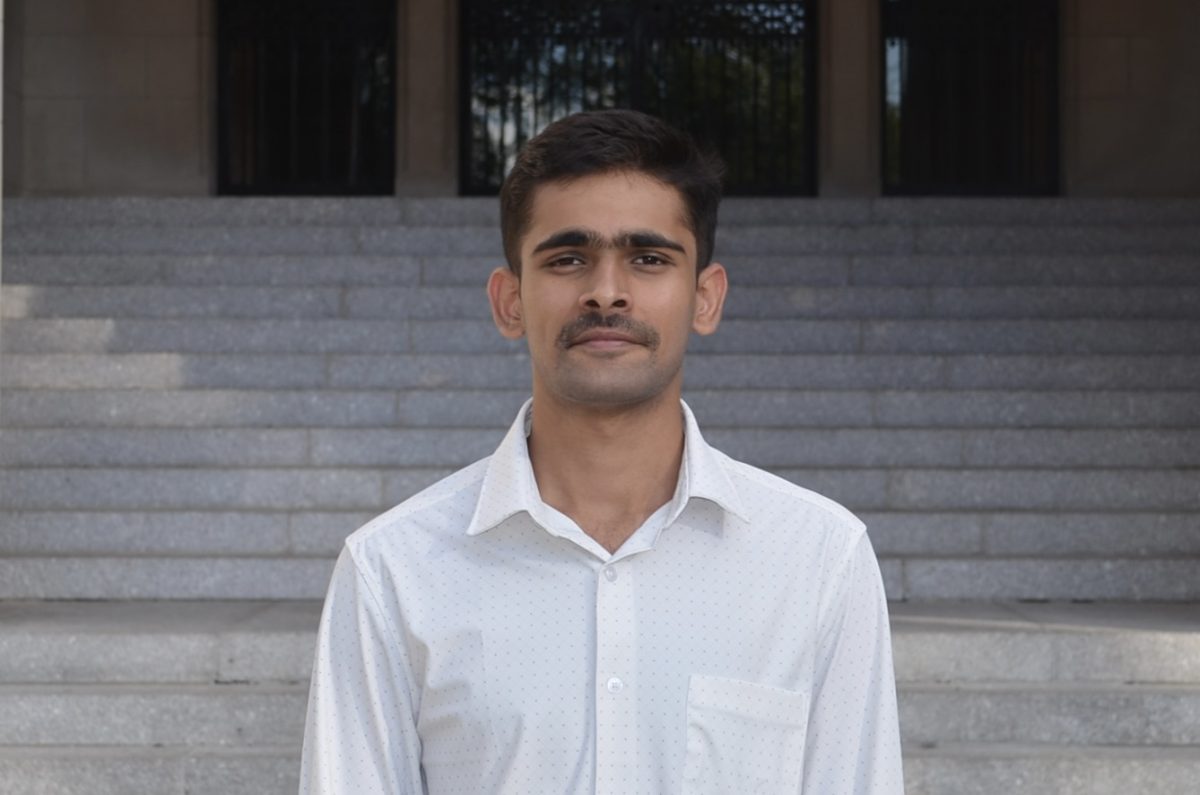

Noah Osborne, FCRH ’23, is a journalism major from Harlem, New York.

Tom • Nov 1, 2019 at 10:51 am

Love that you’ve taken the time to write about this topic. It is vital to a happy adulthood- not being stressed about money.

Linsey Deynes • Sep 25, 2019 at 7:45 am

Well written..

Financial literacy course are very important for our kids future..

So proud of you Noah Osborne