Biden Will Weaken U.S. Dollar and Increase Living Standards

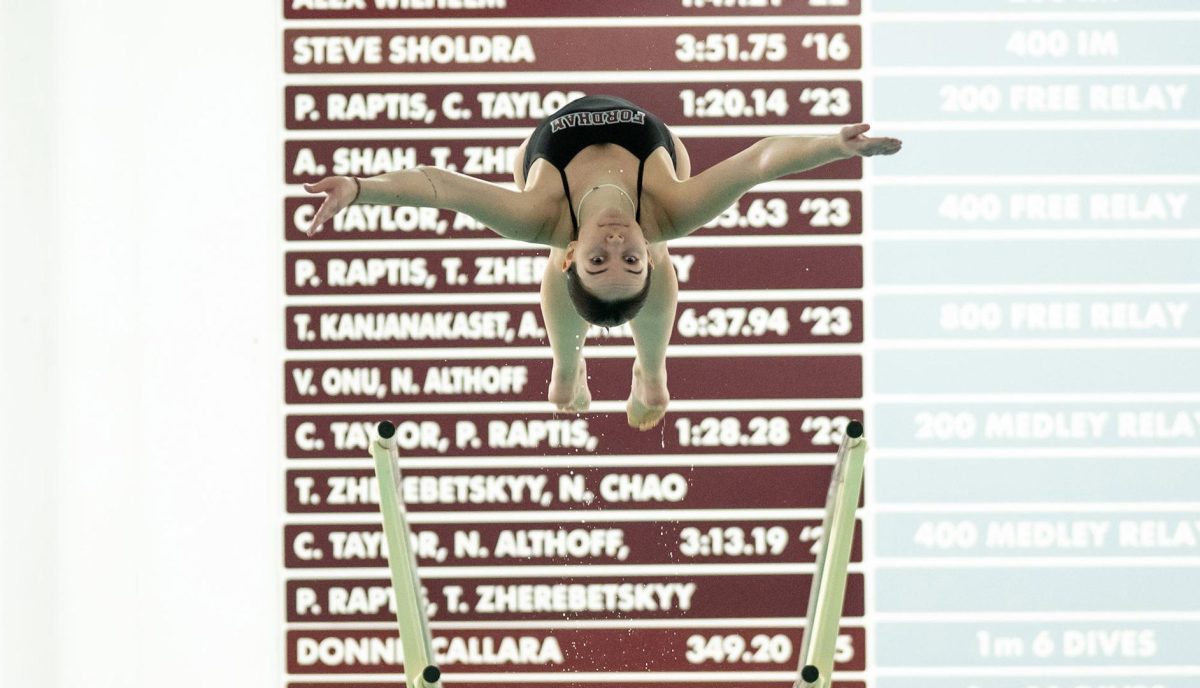

Biden’s presidency will have a positive impact on the economy (Courtesy of Flickr).

Achieving a weaker dollar has been a popular talking point over the years and has translated into President Donald Trump and President-elect Joe Biden centering their economic plans around this idea. A weaker dollar not only helps U.S. exporters but also encourages American production and manufacturing. Both politicians aim to achieve this by increasing the federal deficit, but their taxation and government expenditure methods differ. Although Trump’s drastic tariff implementations on China and other countries have generated greater government revenue and fewer U.S. imports, they have directly harmed American small businesses and consumers. These small businesses have paid more than $32 billion in additional taxes, while JP Morgan estimated that every middle-class family lost up to $1,000 and the Congressional Budget Office (CBO) estimated that the average family would lose roughly an additional $580 in 2020. The CBO has also acknowledged that White House trade advisor Peter Navarro’s claim of having China pay for tariffs was incorrect and that the tariffs realistically cast a larger share of their cost than previously estimated on Americans. On the other hand, Biden intends to work for middle-class Americans’ best interests through necessary funding in stimulus packages, education, infrastructure and renewable energy. Due to neither political party taking much action towards cutting government expenditures, the U.S. dollar will remain weak regardless of the election results. Still, the implementation procedure of stimulus action and normalization of trade policies have a crucial impact on American families. That being said, Biden’s willingness to prioritize government investment would be a better option for American citizens and businesses than Trump’s tariffs and trade wars with China.

Before measuring Biden’s actions related to weakening the American dollar, let’s first analyze how President Trump’s tariff measures have achieved this. Trump’s “America First” approach of imposing approximately $355 billion in tariffs on imports related to steel, aluminum and other goods from China was not effective in helping middle-class Americans. These tariffs decreased trade altogether. As imports and exports fell, prices for outsourced products surged and ultimately fell on American consumers and businesses. In addition to the American Action Forum, tariffs on aluminum were reinstated a couple of months ago, which will increase American consumer costs by $582 million per year. It is also important to look at the jobs that are supported by global trade. Around 40 million (one of every five) jobs in the U.S were negatively affected by these tariffs. Moreover, people who work in farming and manufacturing, who make up a significant portion of President Trump’s voter base, got hit the hardest. Therefore, it is counterintuitive for these middle-class Americans to vote for policies that jeopardize global trade and directly worsen their living standards. The only winners of the China/U.S. trade war were Vietnam, Taiwan and France, as they all had increases in total U.S. imports. At the same time, American manufacturers and farmers continued to suffer. And after all of this, the trade-weighted U.S. Dollar Index has moved about one index point since Trump’s inauguration.

The President-elect and the Democratic-majority House of Representatives plan to weaken the dollar through the party’s carefully-chosen government expenditures, including education, infrastructure and renewable energy. The Democrats’ newly outlined stimulus package, Emergency Action Plan to Save the Economy, proposes reviving small American businesses and helping people get back on their feet. Similar to former President Barack Obama’s stimulus package in 2009, Biden aims to assist Americans with finding employment, prevent families from falling into more debt and urge big corporations to commit to helping their workforce and the communities in which they operate. Suppose these actions are implemented correspondingly to the American Recovery and Reinvestment Act of 2009. In that case, millions of full-time jobs will be created, consumer confidence will soar to near pre-COVID-19 rates and children will receive better educational instruction, all within four years. All of these measures will spur economic growth for all of America, just like in the past when the average GDP per capita annual growth rate was around 3.1%. In contrast to Trump’s actions, Biden’s plan for economic growth will benefit Americans by providing them with full-time jobs, better education and a cleaner future with renewable sources of energy. As a result of all of these government expenditures, economic activity will weaken the dollar effectively while also increasing middle-class Americans’ living standards.

Ultimately, Joe Biden’s focus on improving education, infrastructure and research concerning renewable energy will be more effective in weakening the U.S. dollar than Trump’s efforts in starting trade wars with other world powers.

Mikael La Ferla, GSB ’23, is a business administration major and information systems minor from Philadelphia, Penn.