Elizabeth Holmes Is a Forewarning for All Bigwigs of Silicon Valley

Using only a single prick of blood for testing purposes, Theranos attempted to revolutionize the medical industry. The efforts were spearheaded by a charismatic CEO intent on changing the world. It sounds like the perfect investment opportunity: a way to buy into the future of biotech.

However, beneath the facade of revolution was a crumbling company that misled its investors to keep afloat. The story of Elizabeth Holmes and her company, Theranos, is a cautionary tale to other tech ventures, but it’s not unique. Unfortunately, the culture of Silicon Valley creates an environment ripe for fraud.

Within Silicon Valley, there is an encouragement to get shareholders involved with a high-risk, high-reward culture. CEOs must ask themselves if the risk of deceiving those invested in the company is worth the reward. Many CEOs find this risk to be worth it, so why is Elizabeth Holmes the only one on trial when so many other tech-related risky start-ups seem to be crumbling as well?

Elizabeth Holmes was following a playbook used by dozens of other tech CEOs: a vision and the ability to persuade others to see that vision, even if the technology had not yet been created. Much like her idol, Steve Jobs, Holmes believed she was forming the future, even as those within her company said otherwise.

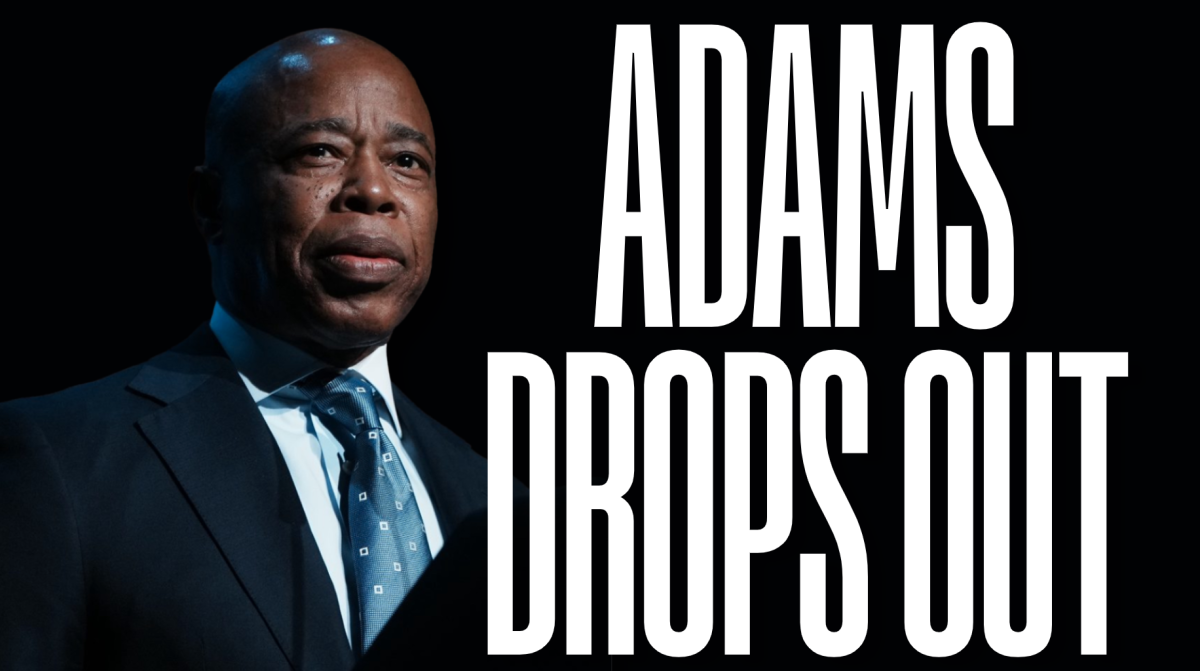

Holmes is not the only CEO who has followed this playbook to failure. Adam Neumann, the founder of WeWork, also faced widespread allegations of misleading shareholders and overvaluing the company upon filing for an initial public opening (IPO).

Other CEOs of major companies have faced controversy during their tenure. For example, Kevin Burns, the former CEO of Juul, left the company after it became connected to the youth vaping epidemic. Elizabeth Holmes might be the only CEO of the group to go on trial, but these issues point to a more significant problem within tech start-ups and the culture of Silicon Valley.

The difference between Elizabeth Holmes and the other disgraced CEOs of Silicon Valley is the evidence that prosecutors have against her.

First, Theranos’ position as a biotech company places more emphasis on the potential risk to the health of others.

Secondly, prosecutors allegedly have evidence that Holmes acted intentionally to defraud investors. This can be pretty hard to prove in white-collar fraud cases.

Just because prosecutors were able to find evidence to try Elizabeth Holmes with fraud doesn’t mean that other CEOs aren’t guilty of ruining other peoples’ lives or finances.

In the aftermath of the Holmes trial, the culture of Silicon Valley will most likely remain stagnant as other business bigwigs continue to distance themselves from the failure of Theranos. Current and future CEOs should look at the collapse of Theranos and Elizabeth Holmes as a lesson for how to run a business.

“Innovators who seek to revolutionize and disrupt an industry must tell investors the truth about what their technology can do today, not just what they hope it might do someday,” says Jina Choi, the director of the SEC’s San Francisco regional office.

The playbook used by CEOs of Silicon Valley promotes fraud and something must be done to change it. First, there needs to be more transparency between investors, and companies about the product being developed. Whether this is a change in the investment culture or actual changes in the law, the scenario and assumptions made in Silicon Valley need to change.

Samantha Scott, FCRH ’24, is an international political economy major from Columbus, Ohio.