Financial Literacy: The Subject Matter Higher Education Is Lacking

If you’re an undergraduate college student who isn’t studying business, chances are you feel behind in your financial knowledge. Therefore, it would be beneficial and anxiety-relieving for students to have a basic education regarding the economy and personal financing, no matter what your course of study may be.

For most students, the undergraduate experience is intensely focused on planning for the future in both a professional and personal sense. For students who are not studying in an economic field, the financial knowledge required to begin a professional career post-graduation is often lacking.

It may seem early for college students to be concerning themselves with retirement plans, but by starting to invest young, students can end up saving hundreds of thousands of dollars by the time they retire.

Chase Bank provides an excellent way for someone to have nearly $200,000 by the time they retire if they invest $100 per month from ages 25 to 65.

A highly suggested plan for investment for college students is a Certificate of Deposit, or CD. This is a great option for students, especially those who simply want to gain exposure to the world of investing.

In exchange for committing a certain amount of money to the bank for a set amount of time,payments are often made on a monthly basis, a CD will pay a fixed amount of interest.

This is one of the best ways for students to get their foot in the door of investing, especially because a CD will allow them to accumulate money with a certain future goal — like retirement — in mind. It is not an imminent investment, and therefore is not as intimidating.

For some colleges, educating students in the world of investment is part of the curriculum. This is not a new concept; certain universities have been exposing undergraduates to the investment process since the later half of the 1900s.

For example, the University of Northern Colorado Foundation gave undergraduate students $200,000 of the endowment in 1992. Each semester following, twelve seniors in an investment class would be charged with the responsibility of more than $500,000 of the university’s total endowment. When examining the outcome, these students were extremely successful in their efforts. Not even 10 years following the launch of the program, the portfolio was worth $546,700. In more recent years, some institutions have begun offering similar opportunities to even younger students.

Many high schools offer business and financial courses as electives. However, the only students enrolled in these courses are those who already know they are interested in pursuing a career in the financial sector.

High school is the optimal time for all students to become exposed to concepts surrounding personal finance. College is generally the beginning of students’ financial independence to some degree; having a basic understanding of budgeting and investing from high school courses would be extremely beneficial.

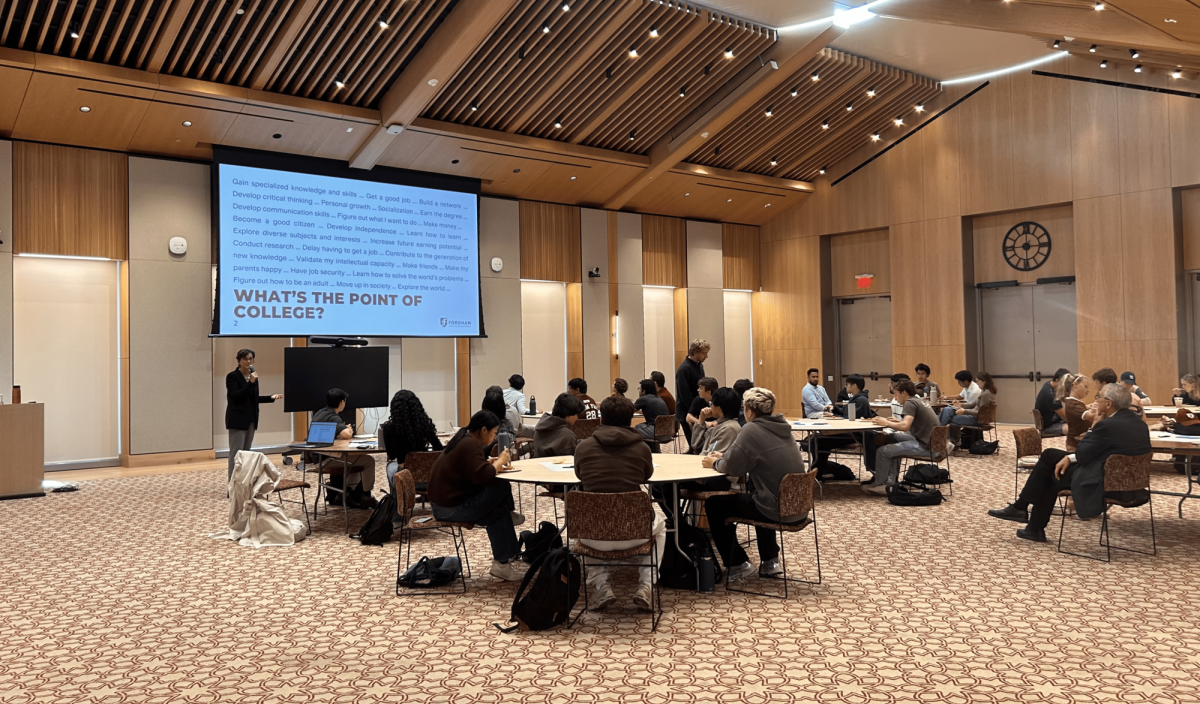

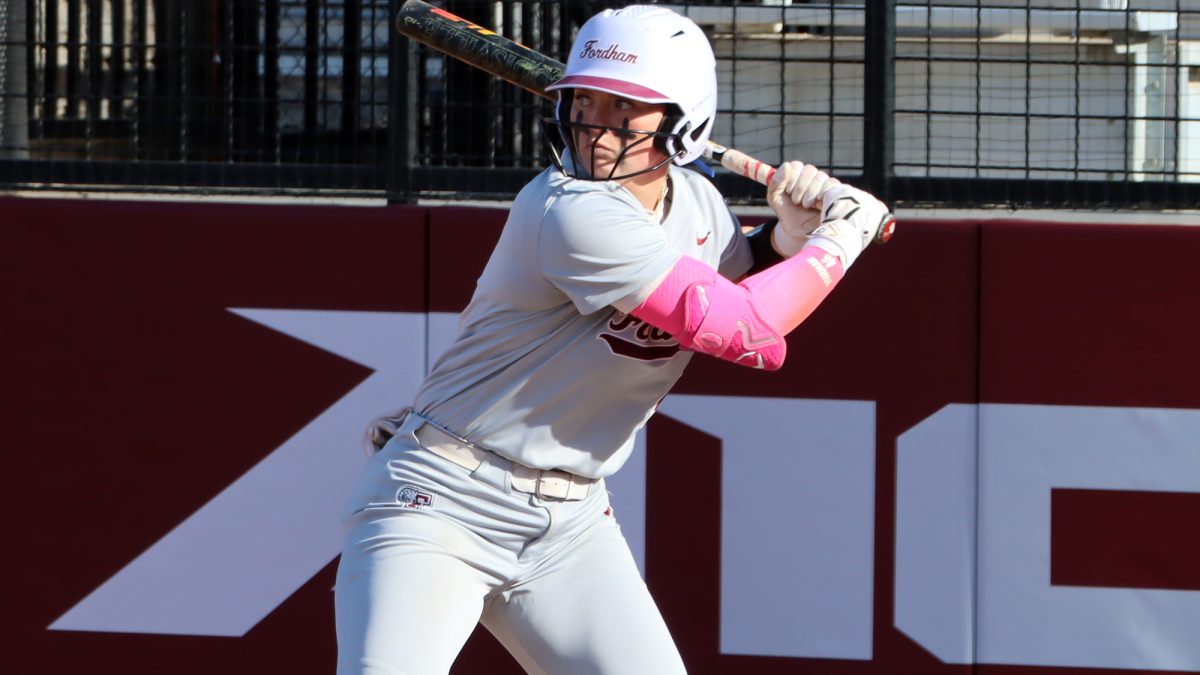

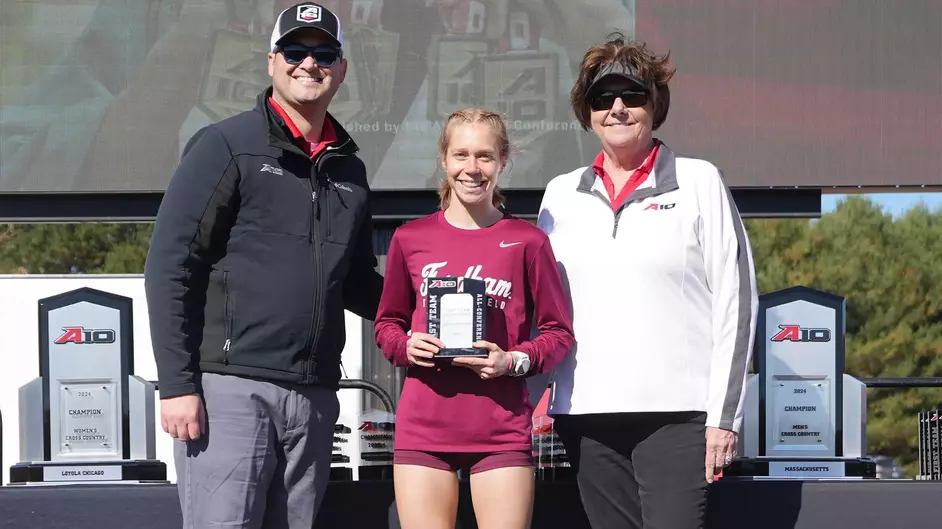

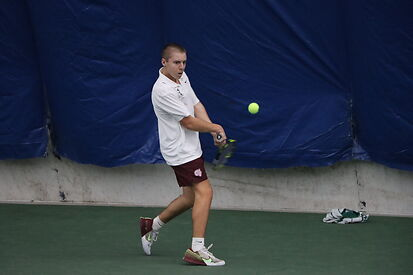

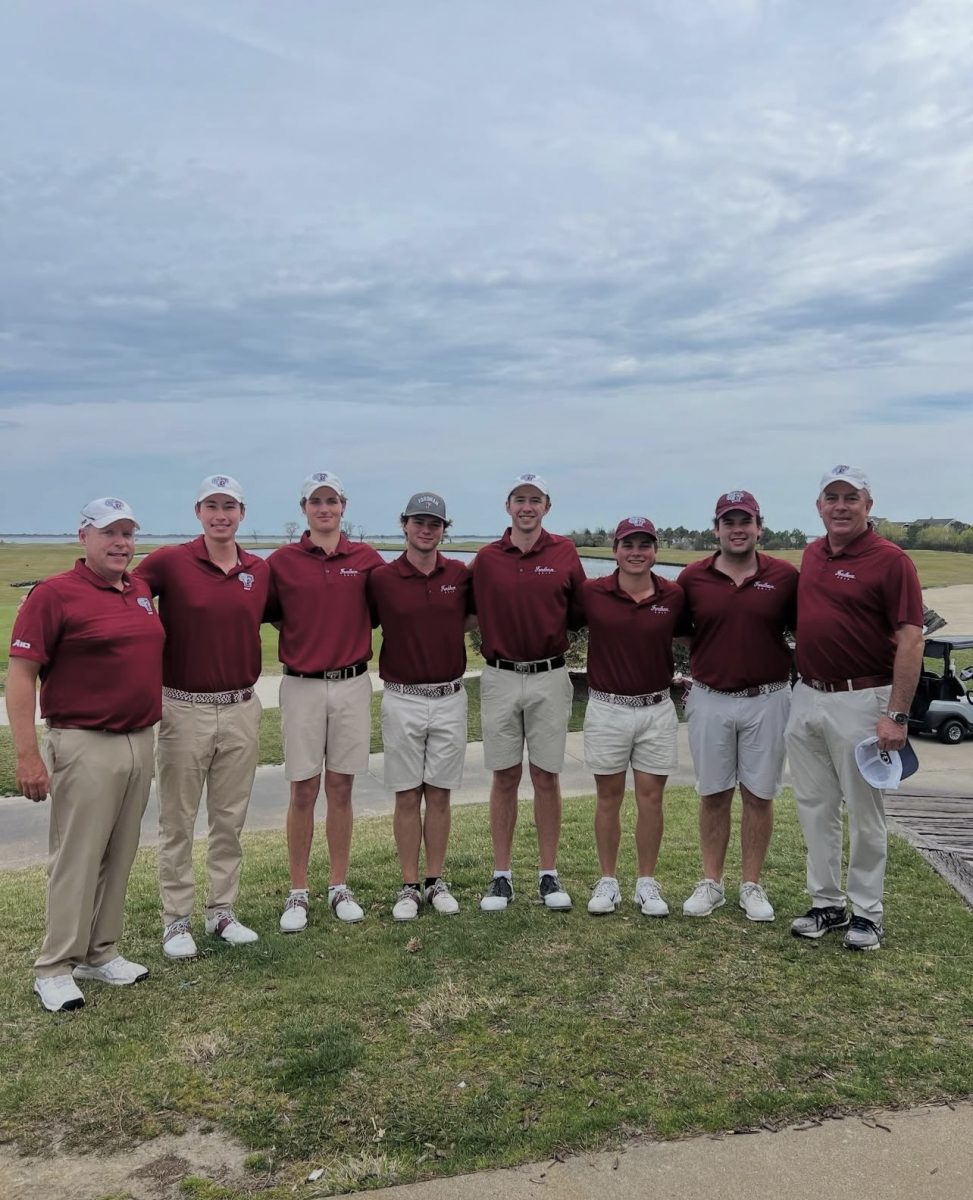

Financial education should be offered to college freshmen as well. In order to encourage healthy financial habits among students, Fordham could offer a lifestyle course required of all first-year students. There is no doubt that the Gabelli cohort coursework, taken during the fall semester of Gabelli students’ sophomore year, provides valuable insight to the business sector and the importance of investing. However, a general teaching of these topics to all students would be very beneficial.

Adding financial education to a first-year seminar course would not only provide students with a basic understanding of independent financial processes, but would also help in their overall transition to college. Studies have proven that enrolling in a first year seminar enhances students’ retention. Why not put that to good use with information about student investing?

Mia Pollack, FCRH ’23, is a psychology and journalism major from Fairfield, Conn.