Kroger-Albertsons Merger Is a $4 Billion Moral Sin

Grocery stores are essential to society. On the surface, they provide communities with a local source of food. However, they also act as a quasi-public space where people gather and interact. Think of the times when you awkwardly bumped into your teacher while grocery shopping with a parent and then the proceeding 20-minute conversation. Access to that engagement with fellow community members is under threat.

Kroger and Albertsons, two grocery store rivals with a major share of stores across the United States, are poised to merge together in a deal worth $25 million. Kroger operates stores under the brands of Kroger, Harris Teeter and Fred Meyer and has a strong presence in the Midwest, South, Southeast and Northwest regions of the country. Albertsons operates stores under the brands of Safeway, Acme, Kings Food Market, Shaw’s, Star Market and Jewel-Osco and has a strong presence in the Northeast, Southwest and Northwest.

The deal, set to be finalized in 2024, could mean higher prices because of less competition and store closures. The most controversial aspect of the merger is the $4 billion special dividend Albertsons is paying to its shareholders.

As someone who previously worked at Safeway, I am appalled by this merger and view it as a disaster for the country.

The first reason this merger is a mistake is that it has the potential to raise food prices. Albertsons and Kroger occupy a large portion of the grocery store market with approximately 5,000 stores combined. They argue that a merger allows for lower prices, a simpler supply chain and better competition with other big grocers like Walmart, Costco and Amazon. However, with more power over pricing and a now much more complicated supply chain, consumers will become more dependent on their prices. The pandemic recently exposed just how costly a complex and interdependent supply chain can be. Is their primary goal truly to serve communities, or to have a better fiscal year than Walmart?

Secondly, this merger is a mistake because of the number of stores that would close. In order to get the merger approved by the Federal Trade Commission (FTC), Kroger and Albertsons will have to close stores in areas where there are multiple stores in close proximity. While this may not sound like a big deal, upon a closer look, Kroger and Albertsons stores operate closely to one another in many areas across the country including states like Washington, California, Texas, Illinois and D.C.

These stores would be put into a separate Albertsons-operated company called Spinco with the eventual goal being to sell them off to other buyers. The problem is that the merger assumes there are viable vendors willing to buy these stores. Sure, a significant amount of them could be bought up by local chains, but should a merging strategy really be bought off such a big “what if?” If Albertsons cannot find any buyers to purchase these stores, they will close.

This is a huge issue and leads to the third reason this merger is a mistake: This deal has the potential of decreasing communities’ access to a nearby grocery store. In general, this merger means consumers have less options to choose from. Where do you go if the only store nearby is out of baby formula or does not have affordably priced bread or eggs? This merger is further consolidating the power of the grocery store market into the hands of a few corporations with consumers at their mercy. The merger also has the potential to create food deserts in communities with only one Kroger or Albertsons store. If that store closes, people will have to travel farther for fresh food.

Albertsons and Kroger stores are fixtures of my community. In the greater Seattle area alone, they run four different stores: Fred Meyer, QFC, Safeway and Albertsons.

In fact, I live right down the street from a Fred Meyer, a QFC and a Safeway. In the areas of the country where there is so much overlap between Kroger and Albertsons stores, a majority of these stores closing would mean thousands of employees across the country becoming unemployed or choosing to retire early to salvage their pension. As a former Safeway employee, I know that this shift will likely cause my former coworkers to lose their jobs; to me, that is catastrophic.

The part that angers me the most is that the leaders of the Albertsons corporation are choosing to abandon the ship rather than go down with their crew. Even before the merger began being hashed out in court in hopes of being approved by the FTC, Albertsons was prepared to pay its shareholders $5 billion as soon as late October, right after the merger was first announced. This meant that even before planning a strategy to keep their stores afloat until the merger is finalized in late 2024 or ensuring that employees’ pension plans were protected, the Albertsons corporation shareholders were going to pay themselves first. While shareholders receiving money as part of any large merger is standard, Albertsons is operating on shaky moral ground in their payout sum. Albertsons has $7.5 billion in debt, $4.9 in pensions to pay and is borrowing $1.5 billion to afford their shareholder payouts, all while knowing the high likelihood of many stores closing and employees being left unemployed. Albertsons argues that they have a payment plan for pensions that is funded until 2051 and maintains that this payout will not affect its financial capability to operate stores until the merger happens. Unfortunately for Albertsons, their words cannot mask the truth their numbers tell.

Businesses, especially grocery stores that serve a public good, have a duty to prioritize their consumers and their employees above their shareholders. While they are owned by private corporations that have the authority to run their business as they want, to an extent they also have a responsibility to the communities they operate in.

Currently, the $5 billion payment to Albertsons shareholders has not happened due to a lawsuit by the Washington state attorney general who sued on account of the payment’s legality. The merger itself will be an ongoing process and could face more roadblocks as the FTC determines if it breaks antitrust laws. I hope these companies listen to the community and stop the merger. It would be a moral crime not to do so.

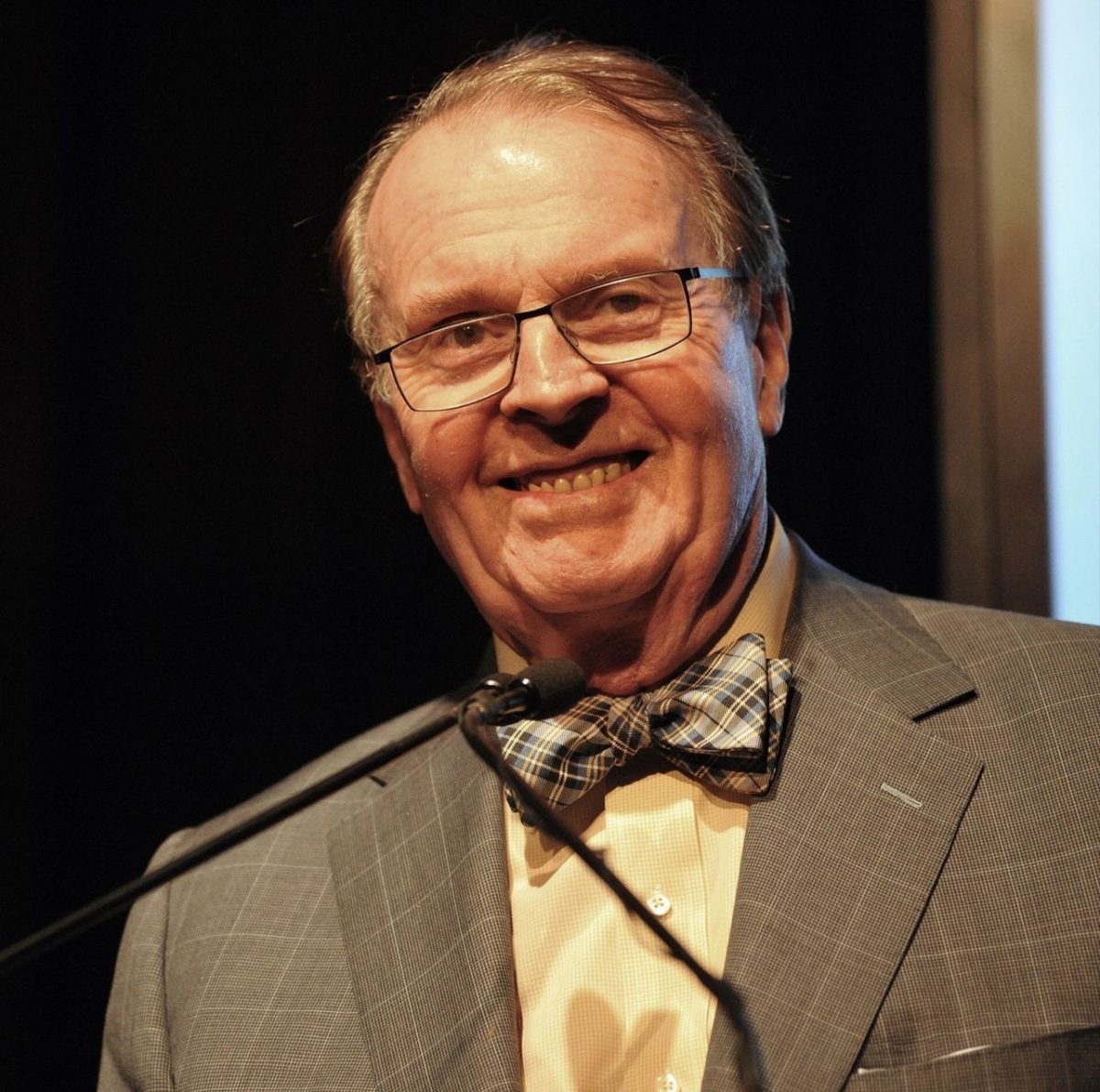

Sarah Kenny, FCRH ’24, is a political science and history major from Seattle, Wash.