By Nick Wetzel

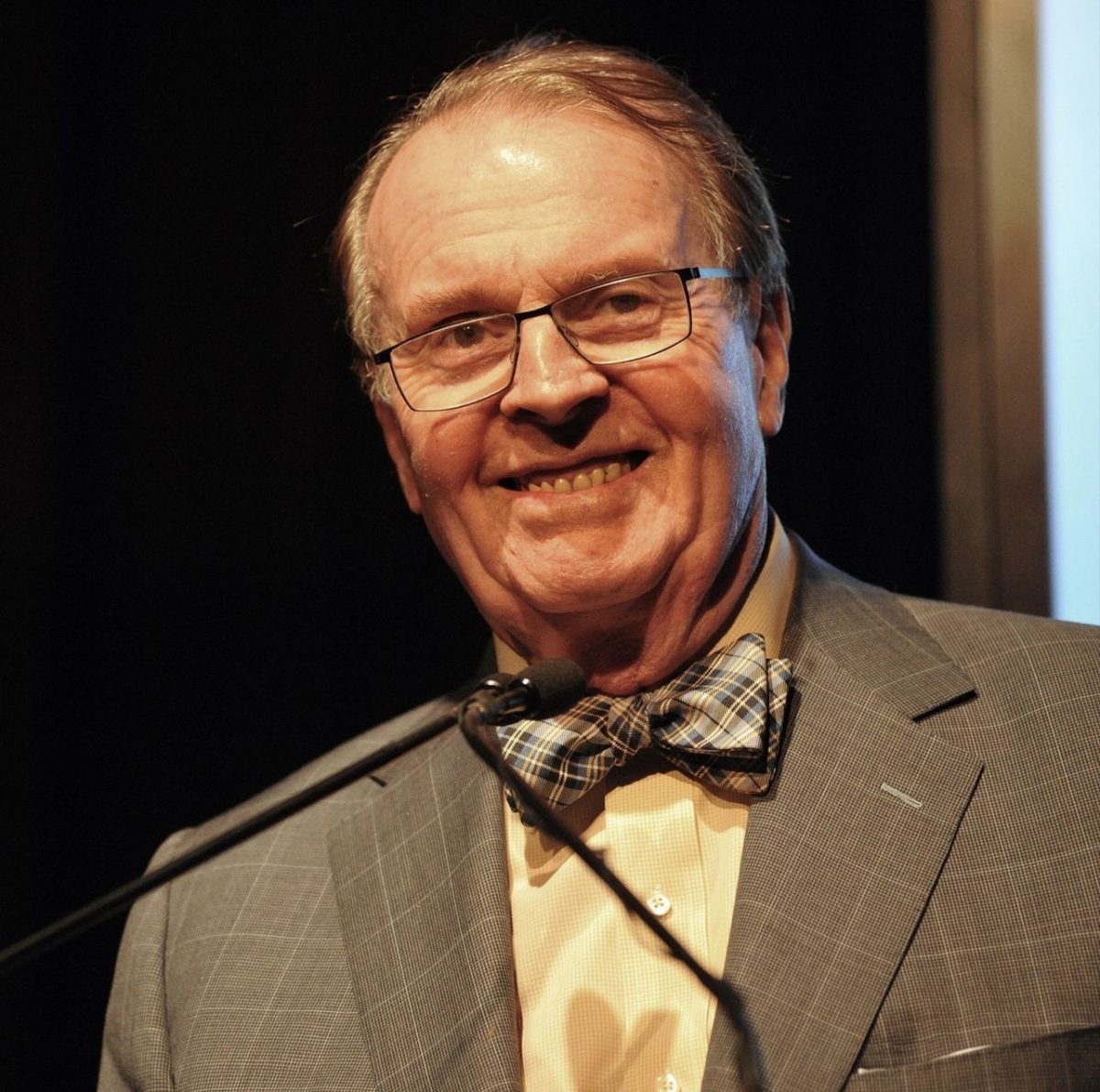

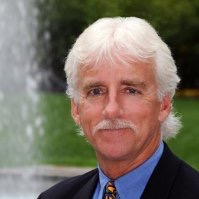

Eric Wood, Chief Investment Officer (CIO) of Fordham University, manages the university’s endowment. In recent years, universities’s endowments has become one of the most important metrics used to rank schools.

What is an endowment? Why is it important?

EW: An endowment is basically a collection of money that friends and family of Fordham have donated throughout the last 100 or so years that have contributed to the university’s cause. Endowments support the efforts of non-for-profits such as universities, hospitals and institutions. Fordham’s endowment plays a critical role in meeting its core mission and augmenting its operations. If endowments are large enough, like the case with Harvard’s endowment, you can let every student attend a university for free, forever from the earnings of the endowment.

So who manages Fordham’s endowment? Is it outsourcing to a third party to run?

EW: I’m the chief investment officer at Fordham’s Endowment, I’ve been here for five years. The endowment is managed by me, and I report to the CFO of Fordham and a group of Fordham trustees who serve on the investment committee for the Board of Directors. We don’t buy and sell stocks, rather we use investment managers.

However, assets are managed externally by investment managers who invest in strategies and asset classes.

What is the average gift size to Fordham’s endowment, and what was the largest gift ever?

EW: I’m not exactly sure. We have a lot of recent graduates donating hundreds of dollars, and then donations range all the way up to millions. If there’s a name on the building, that’s a good indicator an alumni contributed a significant amount.

How does Fordham’s endowment compare in size to other university endowments?

EW: We consider it small to medium sized. The oldest endowments, say for Harvard and Yale, are in the range of 25 to 35 billion, so compared to that our endowment of $680 million looks small, but that’s not an entirely accurate comparison. If you look at a basket of Jesuit universities, on the large end you have a school like Boston College who has an endowment of $2.5 to 3 billion and then you go all the way down to a school like Detroit Mercy, who has an endowment size of 30 million. It’s very lopsided at the largest endowments, but the tail is very long.

A lot of universities are referred to as tuition-driven institutions. What does Fordham’s endowment support, and how much of Fordham’s operating costs are subsidized by the endowment in comparison to tuition? If so, what percentage is returned each year to the university?

EW: The spend rate is only about five percent of total operating budget, which means Fordham’s endowment allocates five percent of its total assets to university expenses. At larger endowments such as Yale’s, 40 percent of the operating budget would be covered by the endowment, but five percent is fairly typical for universities our size, so the endowment’s contribution is meaningful, but not dominant. The problem is you have this pile of money from donations that you need to invest and earn a return on in order to meet Fordham’s mission, but you also need to contribute to the operating budget. If you include inflation and growth, that means our endowment needs to earn a 7.5 percent return hurdle in order to meet the spend rate and grow the endowment.

How have our endowment’s returns performed historically?

EW: As of now, it’s south of 7.5 percent, for sure. Over the last 12 months the funds have returned 13 percent, but look you run into problems sometimes depending on your mix of investments. If you look at 2008-2009, a lot of endowments got crushed, Harvard’s total endowment size decreased upwards of 14 percent or more, so during that period our endowment also declined. It’s always challenging to compare university’s returns on investments. We are more concerned about comparing ourselves to our internal hurdle rate than comparing ourselves to the performance of other endowments.

David Swensen pioneered the famous Yale Endowment Model, which focuses on investing in less liquid asset classes like private equity in order to boost returns. The idea is that as an investor, you are given a premium for not being able to pull out of an investment, like you would when you sell a stock. Many universities have tried to emulate Swensen’s model, with limited success. What is your investment philosophy, and where are most of Fordham’s endowment funds allocated?

EW: I buy his philosophy. If you talk to him about Yale’s excellent returns, he’ll say it comes from finding smart people, it’s less about asset allocation. His strategies are not your typical strategy of buying a few hundred stocks and hoping to beat the S&P 500 index by 0.50 percent. Swensen has gone off the beaten path. Our main investment philosophy is understanding the future return prospects for an investment, the risk associated with the investment, and if we already own any of it. If I can understand returns, get comfortable with the risks, and don’t already own any, I should probably buy some. Endowment management is all about managing liquidity, which means that we always need to have cash on hand to meet market calls and contribute to the operating budget for Fordham. Then we hunt for atypical investment ideas that are off the beaten path from stocks. For example, one of the atypical investments we are currently doing is farmland, which is a 10 to 15-year investment where we rent out land to farmers. Farmland allows us to get free options on things like soy and wheat, while also giving us a consistent, higher return. The great part about farmland is it’s not going to be affected by what President Trump does, or by the current happenings in the EU.

Fordham’s ranking on the U.S. News & World Report have fluctuated a lot in the past few years, and one of the primary factors that are weighted are endowment size and performance.

What’s your opinion on the importance of rankings, and why ours has fluctuated so much?

EW: So these endowment investments are proverbial supertankers. It’s very difficult to move them around quickly. We’ve got a strategic mission and we are trying to navigate that. Any change should be driven by a lot of factors, but it takes time to implement them. Because of compounding interest, it’s going to be hard to get to the top of rankings because some elite schools have larger, older endowments. However, our investment program is on a great trajectory, just not as seasoned as older endowments.