By DYLAN DEMARTINO

STAFF WRITER

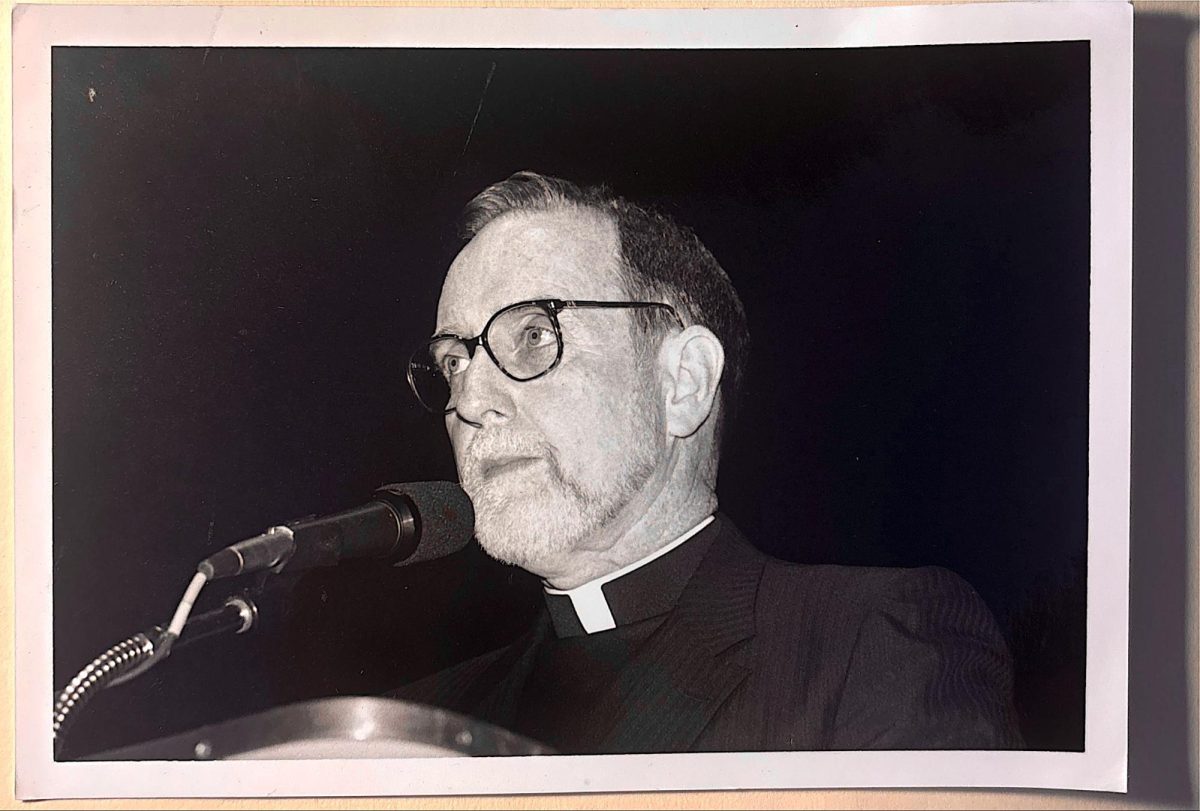

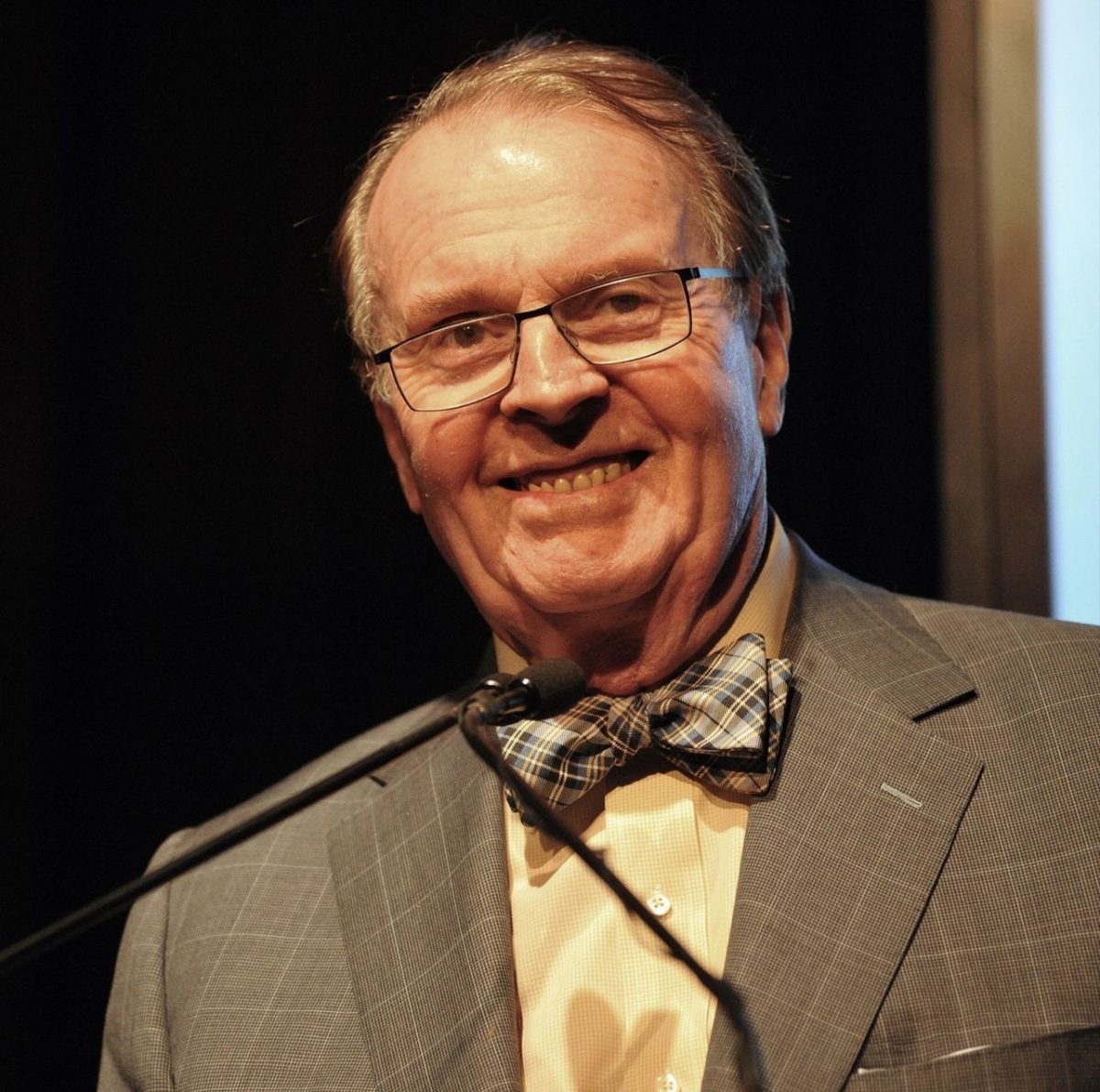

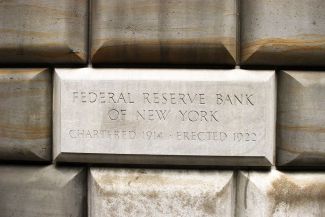

One of Fordham’s most distinguished alumni, E. Gerald Corrigan GSAS ‘65, ‘71, addressed the Fordham community to celebrate the 100th anniversary of the formation of the Federal Reserve Bank of the United States.

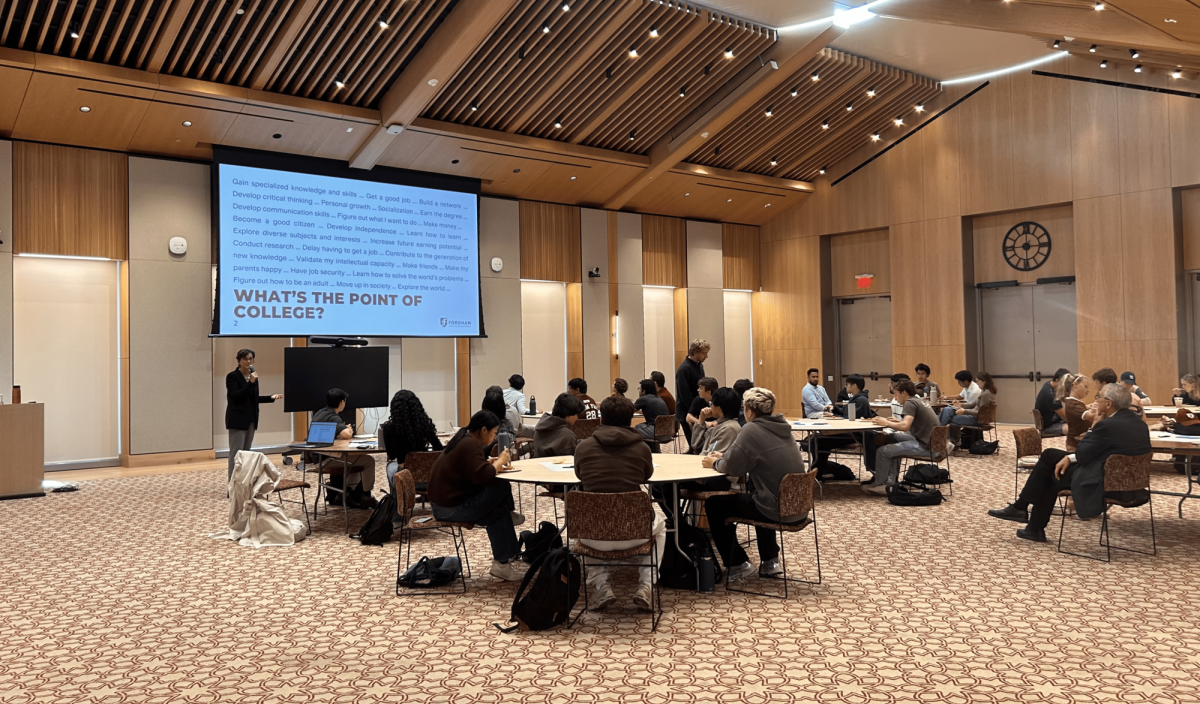

Corrigan is the former President of the Federal Reserve Banks of Minneapolis from 1980-1984 and New York from 1985-1993, he is also a member of the influential “group of thirty.” He is currently managing director at Goldman Sachs. The talk was held on Jan. 14 on the 12th floor conference room in the Lowenstein.

Often referred to as the “Fed,” the American central bank currently governs the monetary policy of the United States. The Fed’s activities and policies ripple through the U.S. and world economies, and are always of great importance to those involved in a slew of business and academic professions.

As the topic of the lecture suggests, the Fed did not always exist, and also did not always possess the broad powers it has today. The current dual mandate of the Fed to create full employment and price stability was not always in place. The Fed was founded in 1913, but it was not until 1951 that the bank became autonomous. The influence of political imperatives and political figures on central banking has long been a contested matter, one that most experts would note is generally detrimental to the ability of a central bank to execute its responsibilities.

Corrigan discussed the evolution of the Fed from the idea of late 19th century figures who studied the role of central banking (or lack thereof) in other parts of the world to the collaboration of financial leaders, to political support in Congress coalescing into the Federal Reserve Act signed by Wilson in 1913. Corrigan emphasized the importance of the pragmatic and idealistic components of the early 20th century (despite the legacy of populist suspicion of large and central banks) in allowing for the Fed to come into existence.

Before the discussion began, Corrigan furnished the audience with a four page information packet featuring a general timeline of events concerning the creation and activities of the Federal Reserve, as well as information concerning important individuals.

The history of the Fed is closely related to American economic and financial history, as changes in the nature or perspective of the Fed often corresponded with important economic developments. For example, the disastrous collapse during the Great Depression may have been lessened by quicker and more evolved action by the Fed, a lesson taken to heart during the 2007 panic.

At the end of the discussion, Dr. Corrigan noted that, despite the instruments acquired by the Fed over the last 100 years, the economy still has issues to be resolved. He was particularly in favor of Fed Chief Paul Volcker (1979-1987), who presided over what Corrigan referred to as the “Golden Age of Central Banking” from the early 1990’s through the early 2000’s.

Following the discussion, Corrigan opened the floor for questions from members of the Fordham community. Individuals from the audience asked questions that focused in particular on future projections for U.S. economic growth, the reintroduction of manufacturing jobs and the performance of Ben Bernanke (2006-2014), the recently-replaced federal chief who held office during the 2007 panic.

Many students walked away from Corrigan’s lecture with a better understanding of the inner working and the history of the Federal Reserve Bank from a Fordham alumni at the top of the economics field.